Comparative Analysis of Petrol and Diesel Price Breakdown in Germany, UK, France, Spain, and Ireland

Introduction

In an era where fuel prices significantly influence both the economy and the environment, understanding the factors that contribute to the cost of petrol and diesel at the pump is crucial. This article offers a comprehensive comparison of the composition of fuel prices across five key European countries: Germany, the UK, France, Spain, and Ireland. By examining the taxes, raw material costs, and additional charges that make up petrol and diesel prices, we gain insights into the diverse strategies these countries employ to manage fuel consumption, promote sustainability, and navigate the complex global oil market.

Section 1: Germany’s Fuel Price Composition

Germany’s approach to fuel pricing reflects its longstanding commitment to environmental stewardship, energy efficiency, and economic stability. As a leader in automotive technology and with a robust transportation network, the country's fuel tax strategy plays a pivotal role in its broader environmental and economic policies.

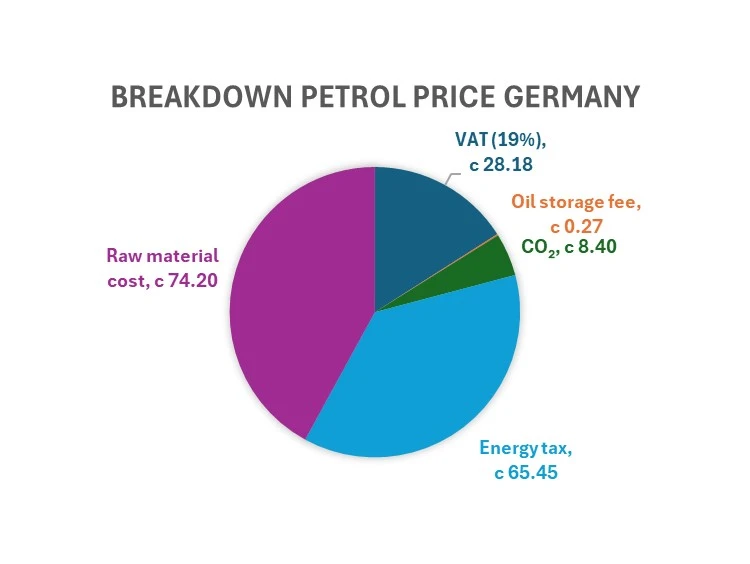

Petrol:

- Total Price per Liter: 176.5 cents, showcasing how taxes significantly influence the final cost to consumers.

- VAT: At 19%, VAT adds 28.18 cents to the petrol price, aligning with Germany's standard VAT rate for goods and services.

- Energy Tax: A substantial component at 65.45 cents, the energy tax is aimed at reducing fossil fuel consumption and encouraging the use of more sustainable energy sources.

- CO₂ Tax and Oil Storage Fee: These charges, 8.4 cents for CO₂ tax and 0.27 cents for the oil storage fee, further reflect Germany's commitment to environmental protection and energy security.

- Raw Material Cost: Before taxes, the raw material cost stands at 74.19 cents per liter, determined by global oil prices and the costs associated with refining and distribution.

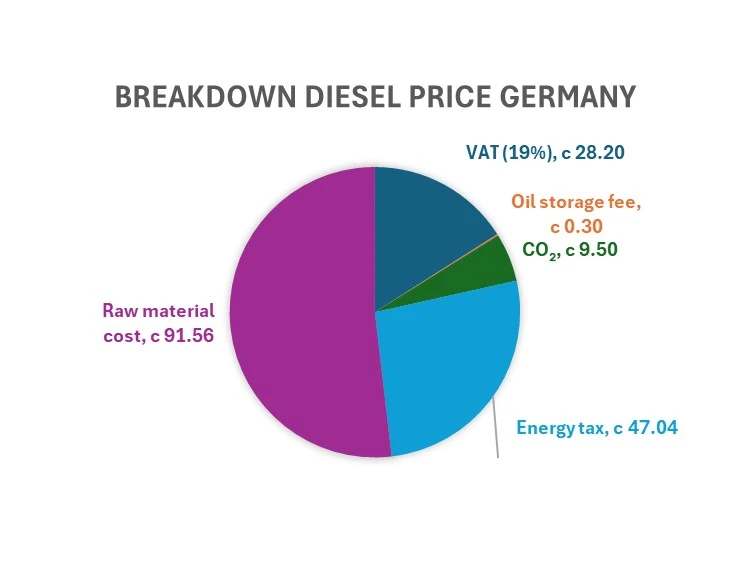

Diesel:

- Total Price per Liter: 176.6 cents, indicating the close pricing strategy between petrol and diesel, despite different uses and environmental impacts.

- VAT and Energy Tax: Similar to petrol, with VAT at around 28.19 cents. However, the energy tax on diesel is reduced to 47.04 cents to support the commercial use of diesel vehicles.

- Environmental Levies: CO₂ tax and oil storage fees are comparable to those for petrol, underscoring the environmental considerations in diesel pricing.

- Raw Material Cost: Higher for diesel at 91.56 cents before taxes, reflecting its different refining process and market conditions.

Germany's fuel pricing strategy, especially the distinction between petrol and diesel taxation, illustrates the country's nuanced approach to balancing economic growth, environmental sustainability, and energy security. The significant tax component of fuel prices is a testament to Germany's commitment to leveraging fiscal policies for environmental outcomes, setting a precedent for comprehensive energy policy planning.

Section 2: UK’s Fuel Price Composition (Prices Converted to Euros at 1 GBP = 1.17 EUR)

The United Kingdom's approach to fuel pricing, marked by significant taxation aimed at promoting environmental sustainability, is pivotal within the broader European context. For a harmonious comparison across the countries discussed, the prices originally listed in British pounds have been converted to euros.

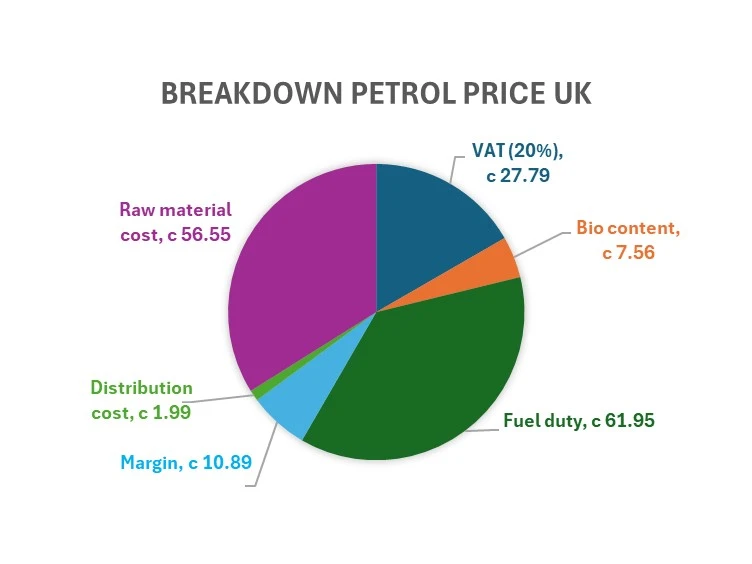

Petrol:

- Total Price per Liter: 166.73 cents, depicting the cumulative costs from various sources.

- VAT (20%): 27.79 cents are added to the petrol price, representing the value-added tax levied by the government.

- Bio Content: At 7.56 cents, this amount shows the UK's commitment to blending renewable fuels into the petrol supply to reduce carbon emissions.

- Fuel Duty: One of the major contributors to the petrol price at 61.95 cents, fuel duty is a key tool used by the UK government to discourage excessive use of fossil fuels.

- Margin: The margin for petrol stands at 10.89 cents, which includes the profits for fuel stations and other operational markups.

- Distribution Cost: This cost, at 1.99 cents, encompasses the expenses associated with the delivery of petrol from refineries to retail outlets.

- Raw Material Cost: At 56.55 cents, this component reflects the price of crude oil and the costs involved in refining and preparing petrol for end-consumers.

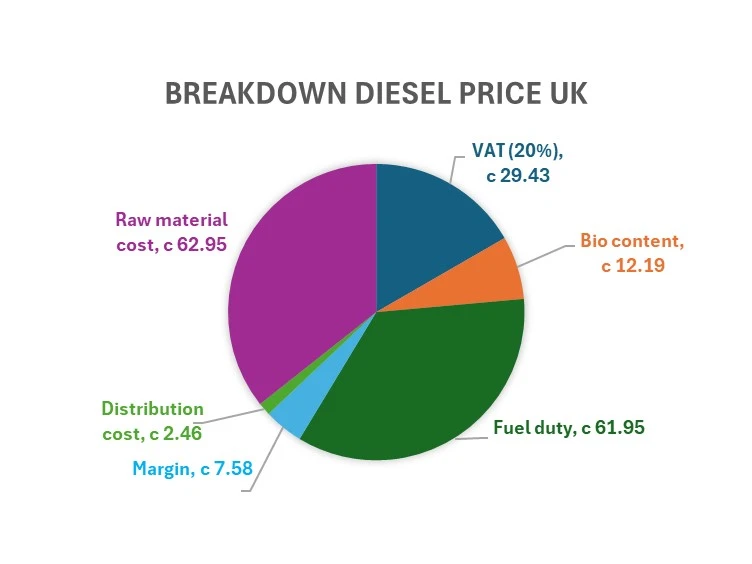

Diesel:

- Total Price per Liter: 176.55 cents, with each component contributing to this final figure as the sum of operational and tax-related costs.

- VAT (20%): Adding 29.43 cents to the diesel price, VAT is applied uniformly across energy products.

- Bio Content: Higher for diesel at 12.19 cents, indicating a greater emphasis on incorporating biofuels into diesel compared to petrol.

- Fuel Duty: Matching the petrol duty at 61.95 cents, demonstrating the UK's consistent approach to taxing fuel irrespective of type.

- Margin: A lower margin for diesel at 7.58 cents suggests a more competitive market or differing cost structures between petrol and diesel.

- Distribution Cost: At 2.46 cents, slightly higher for diesel, which may reflect different logistics or storage requirements compared to petrol.

- Raw Material Cost: The cost for diesel before taxes and duties is 62.95 cents, indicating a higher market price for diesel raw materials compared to petrol.

By converting the fuel prices from GBP to EUR using a rate of 1 GBP = 1.17 EUR, this section aligns with the article's goal to compare fuel price compositions across selected European countries accurately. The UK's strategy, particularly the substantial fuel duty, illustrates a deliberate use of taxation to encourage more environmentally friendly transportation options and manage the societal costs of carbon emissions.

Section 3: France’s Fuel Price Composition

France's fuel pricing strategy integrates significant environmental levies and taxes, reflecting its commitment to sustainability and reducing carbon emissions. The country's approach to managing fuel prices is indicative of its broader environmental and economic policies.

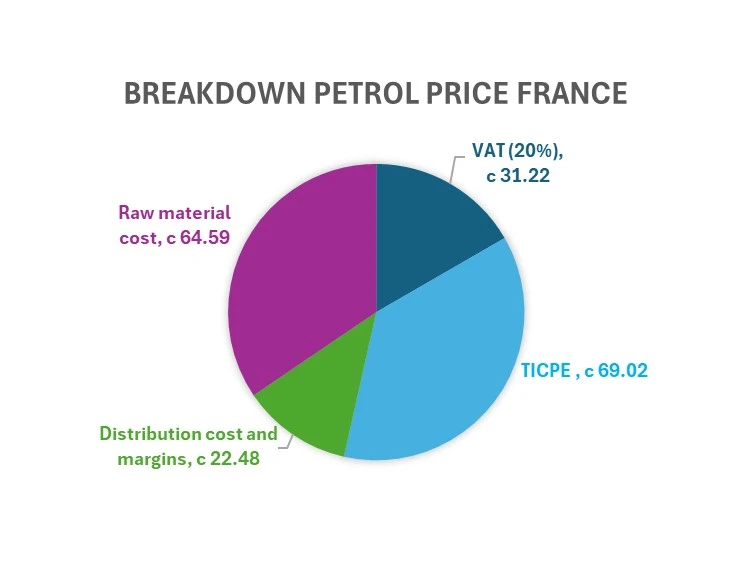

Petrol:

- Total Price per Liter: 187.30 cents, among the highest in the comparison, driven by significant tax rates and the cost of raw materials.

- VAT (20%): Contributing 31.22 cents to the price, this standard rate of VAT is applied uniformly across consumer goods, including fuel.

- Domestic Tax on Petroleum Products (TICPE): A substantial portion of the price at 69.02 cents, the TICPE is key in financing France's environmental and infrastructural policies.

- Distribution Cost and Margins: Accounting for 22.48 cents, this includes the logistical costs of getting fuel to stations and the margins that retailers add.

- Raw Material Cost: Before any taxes and operational costs, the raw material cost stands at 64.59 cents, reflecting the market price of crude oil and refining expenses.

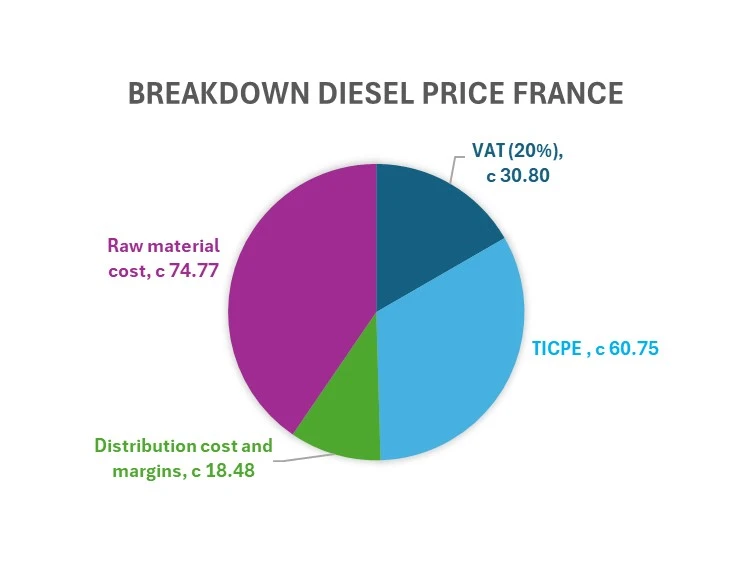

Diesel:

- Total Price per Liter: 184.80 cents, slightly lower than petrol, which is consistent with the approach seen in other countries where diesel is often slightly cheaper.

- VAT (20%): The VAT for diesel is almost the same as for petrol at 30.80 cents, maintaining the consistency of VAT application.

- TICPE: For diesel, the TICPE is slightly lower at 60.75 cents, which may reflect the broader use of diesel in commercial transportation and a slightly different taxation approach.

- Distribution Cost and Margins: These costs are lower for diesel at 18.48 cents, possibly due to different market dynamics and economies of scale in diesel distribution.

- Raw Material Cost: The cost of diesel before taxes is higher at 74.77 cents per liter, indicating different refining costs and market conditions specific to diesel fuel.

France's fuel pricing, particularly the high rate of TICPE, serves not only as a fiscal tool but also as a mechanism to encourage the adoption of more environmentally friendly transportation alternatives. The distinct treatment of petrol and diesel prices underscores the balance France seeks between economic growth, environmental sustainability, and energy security. The country's approach to fuel pricing is a testament to its commitment to reducing carbon emissions and promoting a sustainable future.

Section 4: Spain’s Fuel Price Composition

Spain's approach to fuel pricing reflects its unique balance between economic considerations and environmental policies. The country's taxation and pricing mechanisms for fuel demonstrate an effort to support both the economy and sustainability goals.

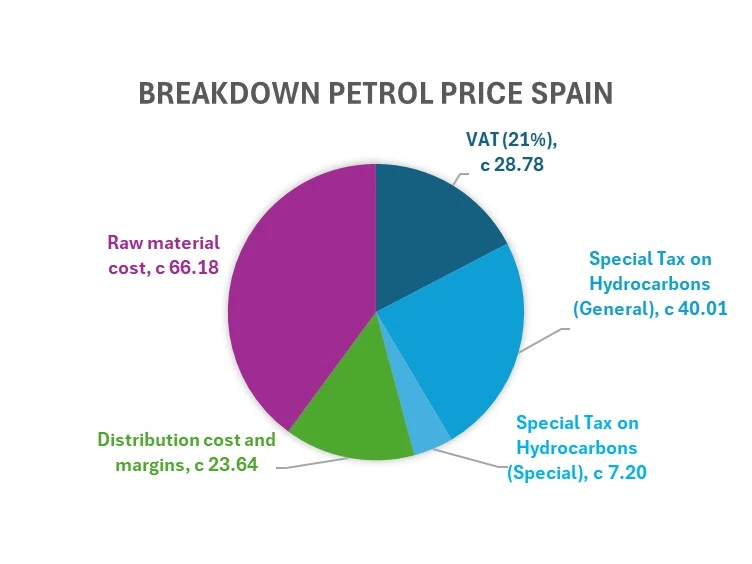

Petrol:

- Total Price per Liter: 165.8 cents, indicating a considerable tax impact and market-driven pricing.

- VAT (21%): Contributing 28.78 cents, reflecting the standard rate of VAT applied to goods and services in Spain.

- Special Tax on Hydrocarbons (General): Adding 40.01 cents, this tax is pivotal in financing environmental and infrastructural initiatives.

- Special Tax on Hydrocarbons (Special): An additional 7.2 cents is aimed at addressing specific regional development and environmental conservation projects.

- Distribution Cost and Margins: At 23.64 cents, these are essential for covering the logistics and profit margins of fuel station operators.

- Raw Material Cost: The base cost before taxes and duties is 66.18 cents, primarily influenced by international crude oil prices and refining costs.

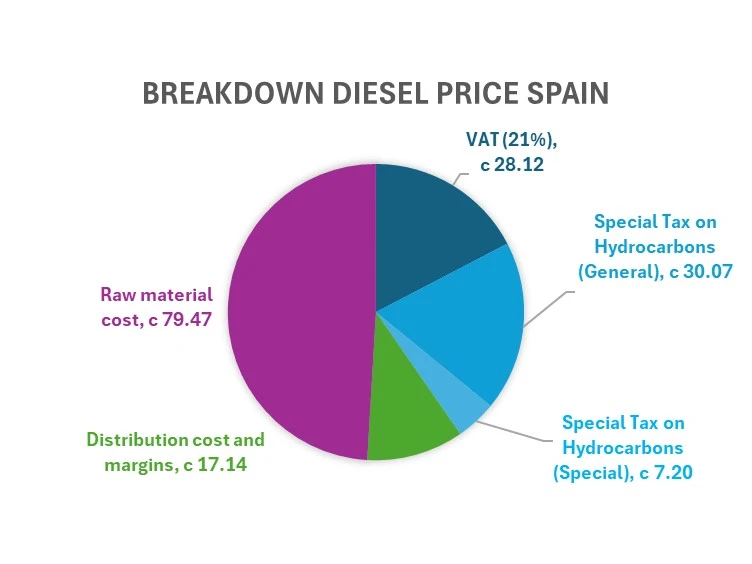

Diesel:

- Total Price per Liter: 162 cents, marginally lower than petrol, which is reflective of diesel's importance in commercial transportation and the agricultural sector.

- VAT (21%): The VAT for diesel is 28.12 cents, aligning with Spain's uniform VAT application.

- Special Tax on Hydrocarbons (General): At 30.07 cents for diesel, this tax is adjusted to support the commercial and industrial use of diesel fuel.

- Special Tax on Hydrocarbons (Special): Consistent with petrol at 7.2 cents, indicating a shared objective for regional and environmental funding.

- Distribution Cost and Margins: Slightly lower for diesel at 17.14 cents, reflecting the operational efficiencies in diesel distribution.

- Raw Material Cost: Higher for diesel at 79.47 cents per liter, this reflects the specific refining processes and economic factors unique to diesel.

Spain's fuel pricing strategy, especially the application of the Special Tax on Hydrocarbons, illustrates a nuanced approach to managing fuel consumption, supporting environmental goals, and ensuring economic viability. The differentiation in taxation between petrol and diesel underscores Spain's commitment to balancing the needs of its citizens, the economy, and the planet.

Section 5: Ireland’s Fuel Price Composition

Ireland's fuel pricing strategy is deeply influenced by its environmental policies and the aim to promote sustainable energy use. The country's approach to taxation and levies on fuel is designed to reflect both the cost of carbon emissions and the necessity of funding energy security measures.

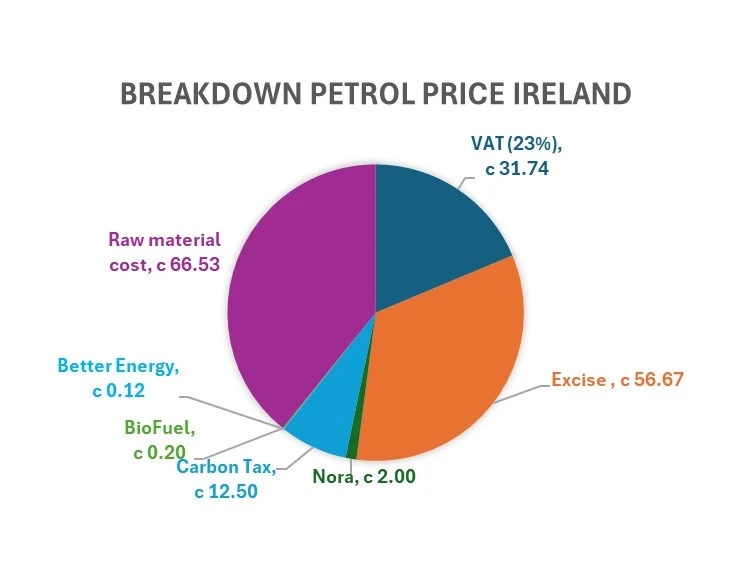

Petrol:

- Total Price per Liter: 169.76 cents, representing a blend of market dynamics and policy-driven pricing.

- VAT (23%): Adding 31.74 cents, indicating one of the higher VAT rates on fuel within the EU.

- Excise Duty: A significant component at 56.67 cents, excise duty in Ireland is a key tool for reducing dependency on fossil fuels.

- NORA Levy: This 2.00 cents levy funds Ireland's strategic oil reserves, crucial for national energy security.

- Carbon Tax: Set at 12.5 cents, the carbon tax reflects Ireland's aggressive measures to combat climate change.

- Better Energy Levy: A smaller contribution at 0.12 cents, showing the commitment to funding sustainable energy initiatives.

- Biofuel Obligation: An additional 0.2 cents is included to promote the use of renewable energy sources in transport fuels.

- Raw Material Cost: Before taxes and levies, the raw material cost is 66.53 cents, primarily determined by international crude oil prices.

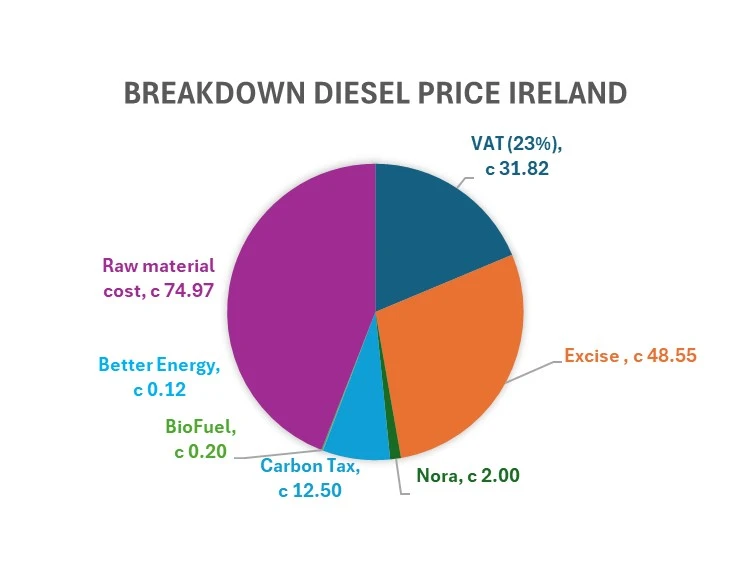

Diesel:

- Total Price per Liter: 170.15 cents, marginally higher than petrol, accounting for diesel's essential role in Ireland's transport and agriculture sectors.

- VAT (23%): The VAT for diesel is 31.82 cents, consistent with the high VAT rate applied to petrol.

- Excise Duty: For diesel, the excise duty is set at 48.55 cents, adjusted to support the commercial usage of diesel vehicles.

- NORA Levy and Carbon Tax: Both levies are identical to petrol, at 2 cents for the NORA levy and 12.5 cents for the carbon tax, emphasizing the shared environmental objectives.

- Better Energy Levy and Biofuel Obligation: These remain the same as petrol, at 0.12 cents and 0.2 cents respectively, underlining the uniform approach to promoting renewable energies.

- Raw Material Cost: Diesel's raw material cost before taxes stands at 74.97 cents per liter, reflecting the specific market conditions and refining costs for diesel.

Ireland's fuel pricing, particularly the emphasis on carbon taxation and excise duties, reflects a comprehensive approach to addressing the environmental impacts of transportation. By integrating significant taxes and levies into the cost of fuel, Ireland aims to reduce carbon emissions, promote energy efficiency, and fund essential energy security measures, all while navigating the challenges of the global oil market.

Comparative Analysis: Petrol and Diesel Price Breakdown Across Germany, UK, France, Spain, and Ireland

The comparative analysis of petrol and diesel prices across Germany, the UK, France, Spain, and Ireland reveals significant insights into the diverse strategies employed by these countries in fuel pricing and taxation. Each country's approach reflects its unique balance between economic objectives, environmental policies, and the global oil market's influence.

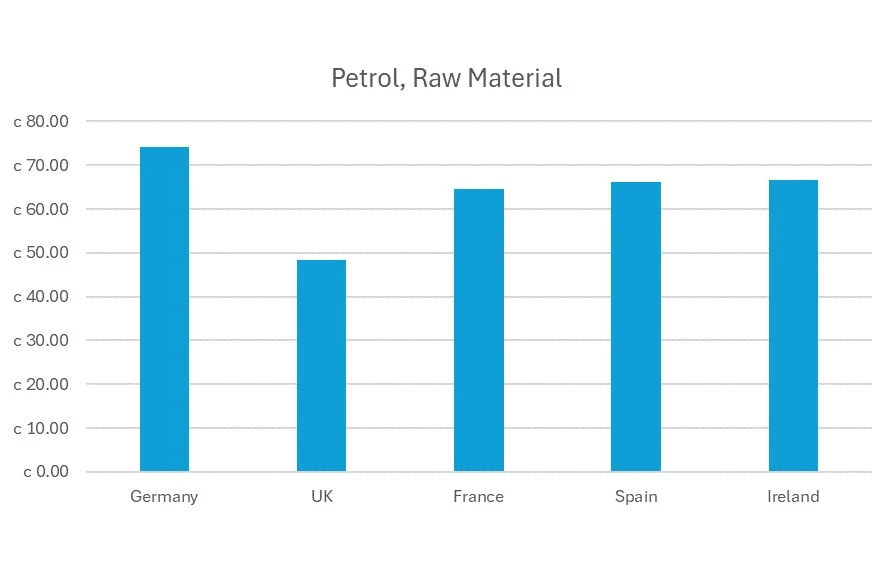

Petrol Prices:

- Germany and France showcase the highest petrol prices among the countries analyzed, largely due to their substantial environmental levies and taxes aimed at promoting cleaner energy use.

- The UK, while having lower petrol prices than Germany and France, still maintains high fuel duty rates, reflecting its commitment to reducing carbon emissions through taxation.

- Spain offers relatively lower petrol prices, with a tax strategy that balances economic considerations with environmental goals.

- Ireland, with its high VAT and carbon tax, demonstrates a strong commitment to leveraging fiscal policies for environmental sustainability, resulting in petrol prices that are among the highest.

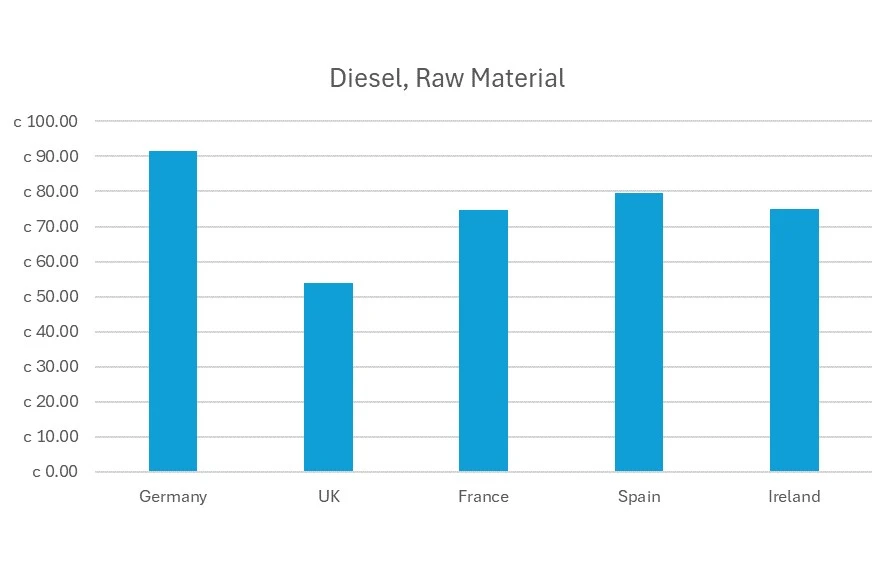

Diesel Prices:

- Diesel prices across these countries generally follow the trend observed in petrol prices, with Germany and France having the highest, due to similar reasons—high taxes and environmental levies.

- Ireland's approach to diesel pricing slightly differs, with a specific focus on carbon taxation and excise duties, reflecting its broader environmental commitments.

- Spain's diesel prices are slightly lower than its petrol prices, illustrating the country's economic reliance on diesel for commercial transportation and agriculture.

- The UK's diesel prices, similar to its petrol prices, are influenced by one of the highest fuel duty rates, aiming to discourage excessive use and promote environmental sustainability.

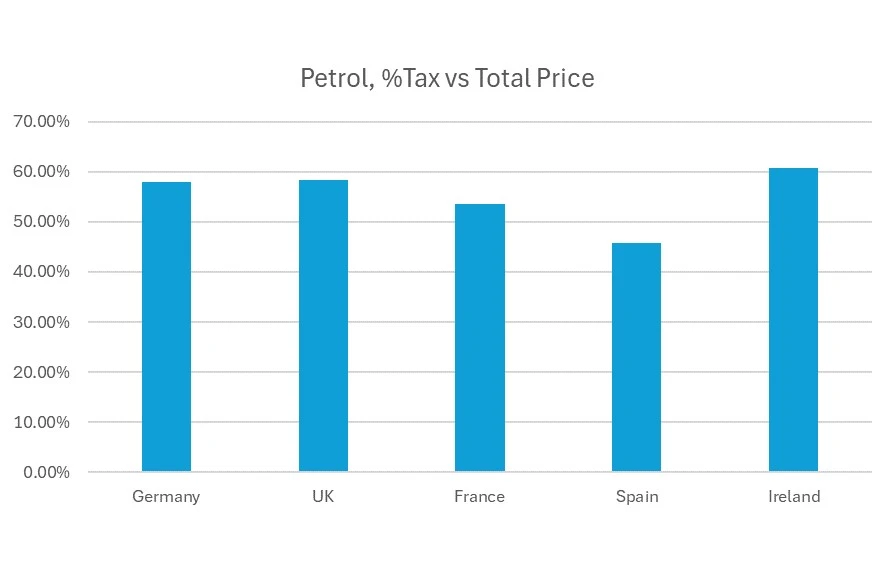

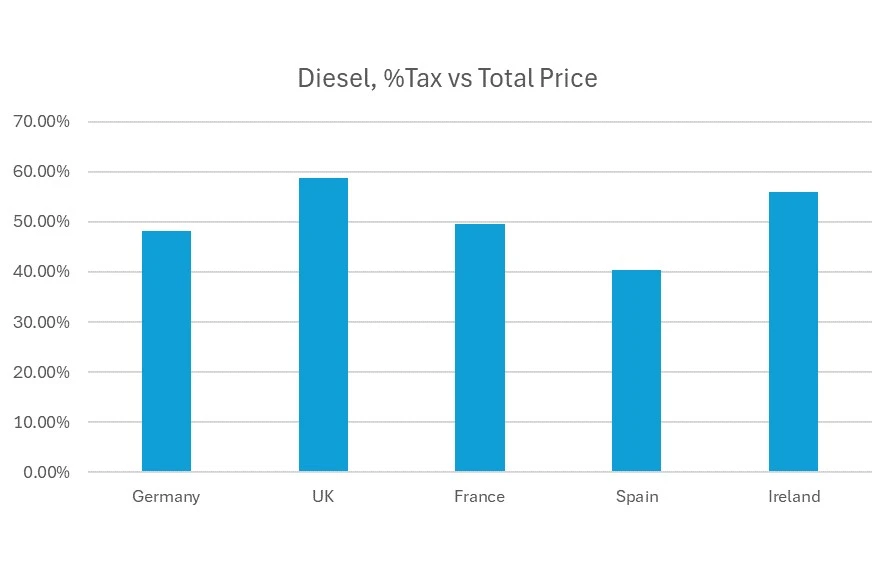

Taxation and Environmental Levies:

- The proportion of taxes and environmental levies in the total price of fuel varies significantly across these countries. Germany and France have implemented substantial environmental levies to discourage fossil fuel consumption.

- The UK's high fuel duty rate on both petrol and diesel serves as a fiscal tool for environmental policy.

- Spain and Ireland, while also focusing on environmental sustainability, have adopted a slightly different tax strategy, emphasizing the balance between economic growth and environmental goals.

Conclusion:

This comparative analysis underscores the complex interplay between fiscal policies, environmental objectives, and market dynamics in shaping fuel prices. While all five countries demonstrate a commitment to reducing carbon emissions and promoting cleaner energy sources, the methods and outcomes vary. The differences in petrol and diesel prices across these countries not only reflect their individual policy choices but also their broader economic and environmental strategies. As global discussions on energy sustainability and environmental policy evolve, the insights from this analysis offer valuable perspectives on the potential pathways for balancing economic growth with environmental protection.

References

- Germany:

- Bundesverband freier Tankstellen e.V. (BFT) for details on petrol and diesel price composition in Germany. BFT.de

- European Fuel Prices report by Cargopedia for general fuel prices across Europe. Cargopedia.net

- United Kingdom (UK):

- RAC Fuel Watch for insights into UK fuel prices and breakdown. RAC.co.uk

- Historical fuel prices and taxation policies provided by the UK government.

- France:

- Official fuel prices and tax breakdown by the French government on Carburants.org.

- Fipeco for detailed analysis on French fuel taxation. Fipeco.fr

- Actu Environment for discussions on distribution costs and margins in France.

- Spain:

- Dieselogasolina.com for current fuel prices in Spain.

- Xataka for an overview of the Special Tax on Hydrocarbons in Spain. Xataka.com

- Repsol Spain for insights into the breakdown of fuel prices. Repsol.es

- Ireland:

- Fuel Prices Ireland for daily updates on fuel costs. Fuelcompare.ie

- Money Guide Ireland for details on excise duty and carbon tax. MoneyGuideIreland.com

- National Oil Reserves Agency (NORA) for the NORA levy information. Nora.ie

- Government documents for biofuel obligation and raw material costs.